|

Blog 26 February 2012

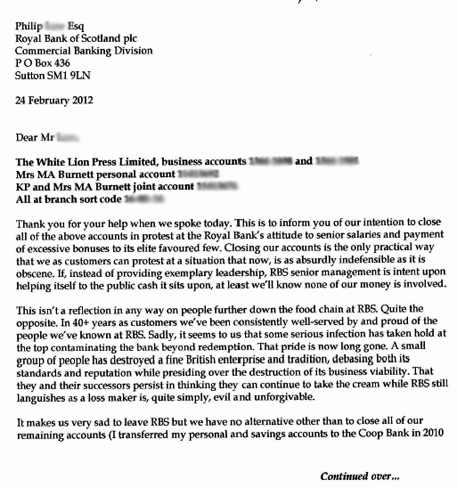

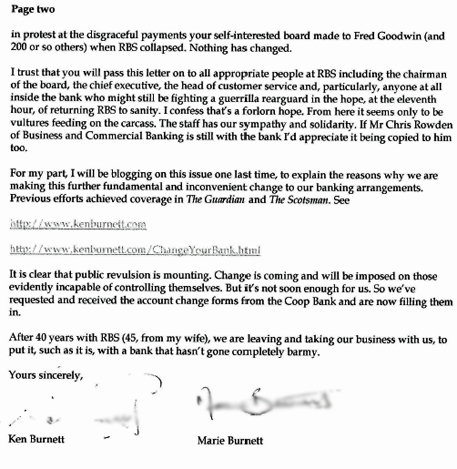

At the news this week that the still massively loss-making publicly owned Royal Bank of Scotland is nevertheless to pay its senior elite mega-bonuses totaling £785 million, we decided it was time to go. Our letter to RBS, below, explains why. Click on the logo above for more on the Change Your Bank campaign. To move your bank accounts to the Co-op Bank click here. We don’t recommend them specifically and changing is probably just as easy with any other bank.

For more blogs from Ken on fundraising and communication click here.

Books by Ken.

|

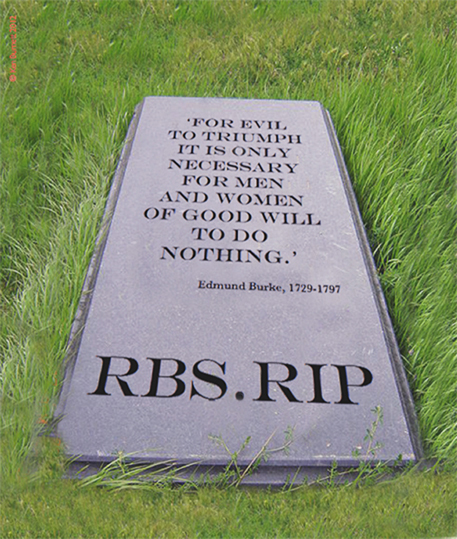

Every right-thinking person in Britain and around the world is shamed and revolted by the greedy, self-serving bankers and their hollow justifications exposed in the latest round of bankers’ pay and bonus announcements. The only action we mere bank customers can take is to take our business elsewhere. So that’s just what we did. It’s inconvenient, but not difficult. And it feels great once you’ve done it. We felt we have to protest in every way we can. Otherwise Burke is right, evil triumphs. If we as customers of these banks don’t forcefully show our disapproval, how will public revulsion ever mount to the tidal wave that will be needed to stop these people? It’s a small gesture for the kind of a society we want to live in.

Surely we have to become the kind of society that

To appreciate why the children of these bankers will, when they grasp the true situation, be ashamed of their greedy parents, consider the arguments put forward to justify the huge salaries and bonuses bankers and others vote for themselves and their cronies (often dozens and even hundreds of times the average pay of their fellow workers). They do a really difficult job.

They have to make difficult decisions.

Bankers do really important jobs. They need to be paid shed-loads, and then some more, so they can attract the best.

If we don’t pay them vast bonuses on top of their vast salaries, they’ll leave.

Introducing fairer salary structures will irreversibly damage the world’s image of the City of London.

Try any of the above arguments on a reasonably intelligent 12-year-old and he or she will quickly see through the fabrications the bankers have spun to justify their avarice. The only reason they pay themselves these sums is because they can. Because no one has stopped them. Better late than never, a few politicians are now repeating what many of the public have been saying for some time.

We live in a country that, thanks in no small measure to the reckless mismanagement of these same bankers, is obliged right now to cut the salaries of its public workers, reduce health and welfare services and scrap basic essentials to the poorest and the most needy. Yet in the last three decades in Britain the rich have got massively richer and the poor proportionately much poorer, so that now we have returned to a social divide similar to the chasm that stood between the aristocracy and the masses at the turn of the 1900s. And the country has not yet begun to be repaid for the risk it took in bailing out the banks, at the cost of £billions. This, rather obviously, is no time for bankers’ bonuses. Aside from the arguments for morality and fairness and the rejection of greed and self-serving there’s another overriding reason for changing this paradigm fundamentally, now. Quite simply, the fabric of our society is at risk if we don’t. There’s now real danger of serious unrest, or worse. Far from inconceivable, protests and even riots in our streets seem likely to be an increasing feature of our lives, unless our society vigorously addresses all its unfairness issues. An unequal society is an unhappy society. When our society becomes fairer for all, everyone – except perhaps the few who deserve to be disappointed – will be very much happier and more contented. Please, let’s all push for this one fundamental, achievable change in our society. You can start by changing your bank. It’s a really good feeling, when you do. © Ken Burnett 2012

|

The standard British reaction to corruption in high places is embarassment or to make jokes about it, perhaps because British people are tolerant, don't like to make a fuss and are slow to anger. This may be changing.

From this article: a result! 27 February 2012

Disagree with us? Or agree? If you’ve anything to add, have your say here. Email your thoughts or comments now to me and providing they’re

Ken and Marie Burnett started a marketing and communications agency in the early 1980s that grew to employ around 100 people. RBS then was a very attentive bank. The business was sold in 1999, after which the pair became noticeably less important as customers. They now have a small specialist publishing business which employs no one and, as Ken says, is ‘a bit like having a large hole in the back garden that from time to time we throw money into’. Ken has written several books on a variety of themes and blogs occasionally on issues to do with fundraising, marketing, communication and natural history. Ken wrote this article. His books can be seen here and current blogs can be accessed here.

|