|

Blog 26th March 2013

An average cost ratio target is about how little you spend, not about how much you get done. Its effect is to restrict how much you can raise, not help you raise more. ... The point is, many more appeals fail to raise as much

Being guided by Home page.

|

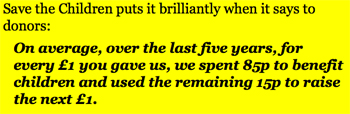

It’s shocking to find anyone, anywhere still clinging to the concept of pinning fundraising performance to an average cost ratio while imagining that’s helpful to the cause. As we’ve done a poor job of informing them otherwise, donors perhaps can be forgiven for persisting with the ‘less cost is best’ fallacy. Yet among some CEOs and charity trustee boards too the notion remains widely held as an aspiration, even today. But boards and CEOs should be allowed no excuse, because the model is simply fatuous. Requiring a fundraising team to adhere to or even be guided by an average cost ratio target will result in underachievement, frustration for fundraisers and lots less money to change the world. For the cap excludes other perfectly viable fundraising activities that would produce additional net income (profit) at cost ratios entirely acceptable to all but the blinkered and unrealistic. So, ignorance of a cost ratio’s impact and consequences should not be allowed to flourish. Given the importance of the job they do, charity boards should be readily able to demonstrate understanding of the basic economics of fundraising. Though far from rocket science, this does call for a little bit of study and some unravelling from popular myths and misconceptions. Then, it all makes sense and serious fundraising can begin. By definition, anyone who says, ‘Our fundraising should perform at an overall ratio of 10:1, or even 3:1, or whatever, hasn’t done that homework. If they had, they’d quickly see that a target of this kind is bound to lead to underachievement, less funds raised and a demoralised fundraising team. To grasp why, boards need to ask, ‘Are our donors and beneficiaries more likely to thank us for spending little, or for raising more? Is our duty as trustees to raise the maximum amount efficiently for our cause, or is it to keep costs down relative to income?’ It’s to raise the maximum, surely, while keeping costs at optimum to do the job properly. No other answer is tolerable. But as US pundit Dan Pallotta and others would put it, an average cost ratio target is about how little you spend, not about how much you get done. Its effect is to restrict how much you can raise, not help you raise more. Fundraising results often decline, over time. So the cap inevitably stifles investment even when returns might be high. The point is, many more appeals fail to raise as much as they might because they underinvested, rather than spent too much. An arbitrary cost cap restricts income and misleads donors while helping no one. Instead of congratulating fundraisers for under-spending, boards should be castigating them soundly for not spending enough. For the very simple reason that both the board’s and the fundraiser’s duty is to raise the maximum funds efficiently for the cause. To do that requires effective fundraising spend, not cheese-paring. No one here is encouraging anyone to tolerate a ratio above what would constitute sound, efficient fundraising. So what should a good cost ratio be? The answer is, it depends, and will vary widely from one method of fundraising to another. That tried, tested stalwart of the fundraising mix, charity shops, rarely performs at better than 1.2:1. But who would deny that an income from a chain of charity shops of, say, £100,000 is a sum worth raising, even though net profits from shops are produced at a cost/income ratio that would certainly fail to pass muster with the ‘fixed ratio’ enthusiasts? Or charity events: these frequently incur costs of 50 per cent of gross takings, often more. Should we avoid events? And what about direct marketing? As in the commercial world the cost of acquiring a customer can take time to recoup before trading at a profit is possible. Should charities stop recruiting donors? What would happen to future legacy income if they did? That would be silly, obviously. Life isn’t that easy. It never was. Boards should be able to grasp this simple fact. Here are a few more reasons why. The question is wrong. The arbitrary fixed ratio model isn’t found anywhere else. It discourages risk and innovation. It’s staggeringly unsophisticated. The public believes spending on admin is wrong. The public still views fundraising as a cost, not an investment. Yet good fundraising averagely generates a return that quickly outstrips market investments, by far. Why are the public (and trustee boards) happy to see charity reserves invested in stocks and shares that averagely return three per cent or thereabouts, while not investing sufficiently in fundraising, which with almost cast-iron certainty will bring in returns ten times better? Often much more. And secure their organisation’s future by building a substantial donor base. Many donors balk at an average fundraising cost as high as one-third of the money raised. Yet I don’t know any donor who, when told, ‘Give me £1.00 and I’ll quickly turn it into £3.00 for the cause,’ wouldn’t say, ‘Go for it!’

We should challenge the assumptions of boards that under-invest in fundraising and so fail to raise the maximum or at least optimum amount for their cause. Rather than applaud their prudence we should condemn them for short-sightedness and over-caution. If we’re not spending more we’re not being brave enough. There is a simple explanation for all these absurd paradoxes. Modern fundraising isn’t just about the money that comes in during the next weeks or months, it’s about recruiting and retaining donors, building lifetime values, laying long-term foundations and relationships. It’s about investing while we can in what are still quite massive paybacks, returns on investment that most of our commercial competitors would give arms and legs for. It’s about raising the maximum, efficiently, for our cause. Most professional fundraising strategies recognise this. An arbitrary average cost ratio does not, and even works against it. © Ken Burnett 2013

|

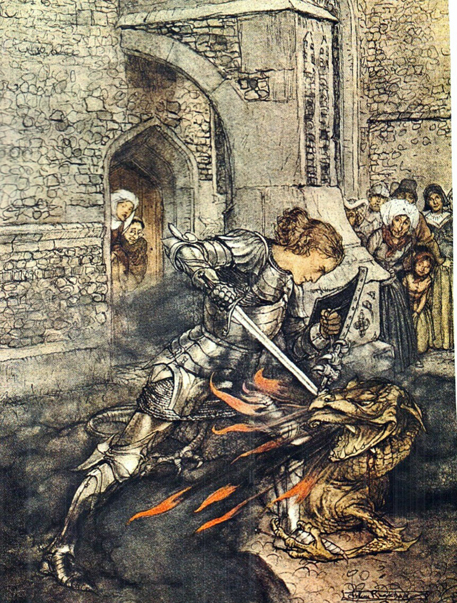

If we would have St George slay our particular dragon we can’t expect to tie his sword hand then hide ourselves behind a convenient though falsely-fabricated shelter.

A quick glance should tell anyone that one size won’t fit all when it comes to the cost ratios of individual fundraising activities. (With thanks to Arthur Rackham for the illustrations and the Free Dictionary for the definition.The 18th century funeral advertisement above left struck me as a metaphor for being overly cautious and protective long after it has ceased to matter.) |